Who Qualifies for Medicare? Let’s Clear Up the Confusion

Medicare is the Federal health insurance program for individuals who are aged (65 and over) and younger individuals who have certain serious health conditions or are disabled.

Medicare eligibility does not take into consideration an individual's income. However, individuals may pay higher premiums based on income, and low-income individuals may be eligible for additional assistance.

To be eligible for Medicare Part A and Part B, an individual must:

- Be age 65 or older, or be under age 65 with certain disabilities or health conditions, including:

- All who get disability benefits from Social Security or certain disability benefits from the Railroad

Retirement Board for 24 months. - Individuals with Amyotrophic Lateral Sclerosis (ALS), often referred to as Lou Gehrig’s Disease or

have an end-stage renal disease (ESRD).

2. Be a U.S. resident; and

- Be either a U.S. citizen, or

- Be an alien who has been lawfully admitted for permanent residence and has been residing in

the United States for 5 continuous years before the month of applying for Medicare.

“Medicare isn’t one-size-fits-all — and eligibility can be more complex than most people expect. My job is to walk beside you, answer your questions, and help you feel confident about what comes next.”

Robin Depies

Heartfelt Financial Solutions, LLC

Let’s Make Your Next Step Simple

I offer no-obligation, no-pressure calls to answer your questions and help you move forward with clarity. I’d love to connect and see how I can support you.

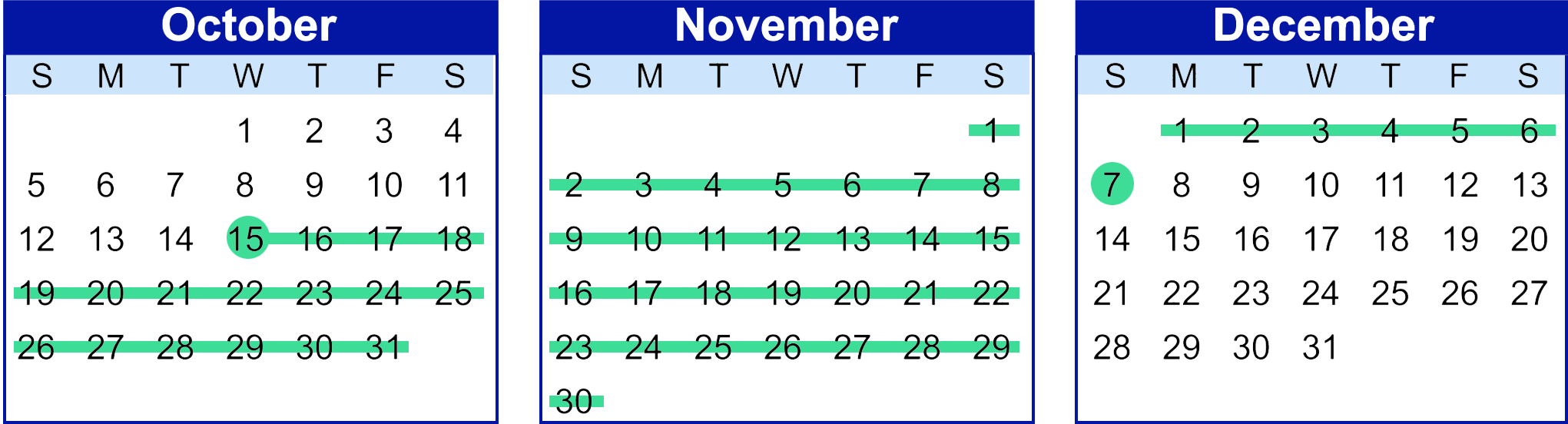

Special Enrollment period (SEP)

(Add, drop or change your Medicare coverage)

Special Enrollment period (SEP)

(Add, drop or change your Medicare coverage)

Certain life events can trigger a special enrollment period from Medicare. You may qualify for an SEP if you:

- Move out of the plan’s service area

- Qualify for Extra Help

- Lose your employer coverage (voluntarily and involuntarily)

- Have been diagnosed with certain qualifying disabilities or other chronic conditions

It’s important to remember that plans are subject to change year-over-year. The plan that you’ve chosen doesn’t necessarily have to be a long-term commitment but form most people, once the enrollment window closes you’ll have to stay on the plan for the rest of the calendar year