Enrollment Made Simple — We'll Review Your Options Together

Turning 65 is a major milestone, and if you're like most people, you’ve probably started getting a lot of Medicare mail — brochures, ads, even phone calls. It’s easy to feel overwhelmed and unsure about where to start. But the good news is: you don’t have to figure it out alone.

At Heartfelt Financial Solutions, I offer one-on-one Medicare guidance to help you make sense of your options — without the pressure, confusion, or jargon. My approach is personal: we’ll talk through your healthcare needs, medications, budget, and preferred doctors. Then, I’ll walk you through the types of coverage that best fit your unique situation.

"Together, we’ll build a plan that supports your lifestyle, health, and peace of mind — now and in the future." - Robin Depies

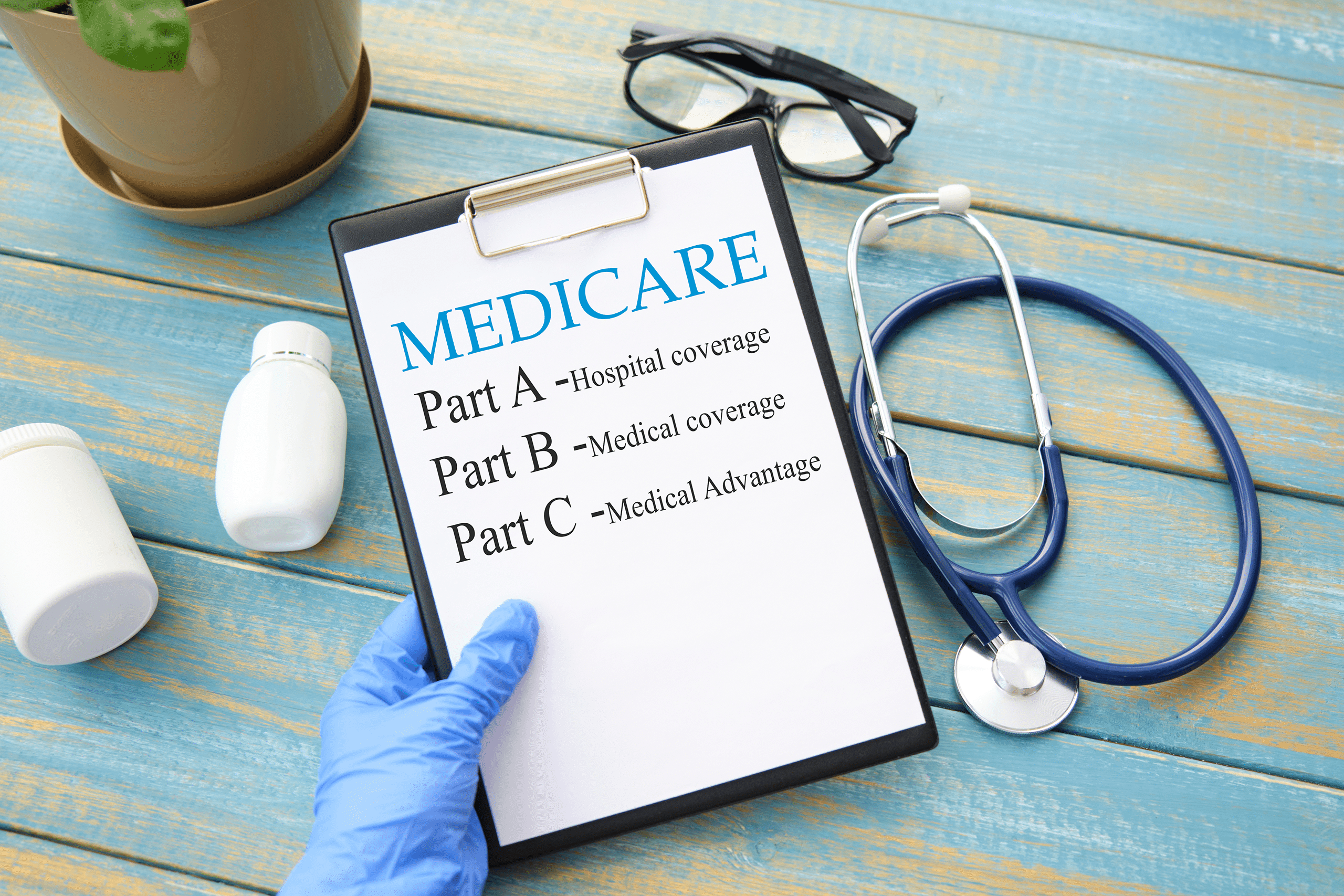

Learn the Basics First?

If you're just starting your Medicare journey, I recommend the ABC's of Medicare, created for people just like you.

What You Need to Know

Learn about timelines, penalties, and when you should apply on this page where you'll find additional information.

What to Expect in a Medicare

Whether you’re planning ahead, already enrolled, or navigating options, I’m here to simplify things and give you confidence.

Common Questions About Medicare

Here are some of the questions I get most often from clients just starting out:

When should I apply for Medicare?

You can apply for Medicare during your Initial Enrollment Period, which starts 3 months before the month you turn 65 and ends 3 months after. But if you're still working or covered by an employer plan, your timeline may be different — let's talk through it. More on Enrollment...

Can I change my Medicare plan later?

Yes, you absolutely have the opportunity to make changes to your Medicare plan during the Annual Enrollment Period which runs from October 15 to December 7, and there are also specific situations, such as relocating or losing your current coverage, that allow for modifications outside of this time frame. At Heartfelt Financial Solutions, I am dedicated to assisting my clients every year as we review their current plans to ensure that they continue to meet their needs effectively and provide the best possible coverage for their unique circumstances.

What’s the difference between Medicare Advantage and Medigap?

Medicare Advantage (Part C) combines hospital, medical, and sometimes drug coverage into one plan. Medigap (supplemental) helps pay out-of-pocket costs not covered by Original Medicare. I can help you compare both based on your health, budget, and lifestyle.

Do I need to enroll in Part D if I don’t take any medications?

Yes — in most cases, if you don’t enroll in a Part D plan when you're first eligible, you may face late enrollment penalties down the road. Even a basic plan can help protect you in the future.

What if I’m helping a parent with Medicare?

That’s very common, and I’m genuinely pleased to assist adult children who are navigating the challenges of supporting their parents. Together, we will carefully walk through the entire process, ensuring that everyone involved feels confident, well-informed, and supported as we address their needs. My goal is to make this journey as smooth as possible for both you and your parents, providing guidance every step of the way.

Common Questions About Medicare

Here are some of the questions I get most often from clients just starting out:

When should I apply for Medicare?

You can apply for Medicare during your Initial Enrollment Period, which starts 3 months before the month you turn 65 and ends 3 months after. But if you're still working or covered by an employer plan, your timeline may be different — let's talk through it. More on Enrollment...

Can I change my Medicare plan later?

Yes, you absolutely have the opportunity to make changes to your Medicare plan during the Annual Enrollment Period which runs from October 15 to December 7, and there are also specific situations, such as relocating or losing your current coverage, that allow for modifications outside of this time frame. At Heartfelt Financial Solutions, I am dedicated to assisting my clients every year as we review their current plans to ensure that they continue to meet their needs effectively and provide the best possible coverage for their unique circumstances.

What’s the difference between Medicare Advantage and Medigap?

Medicare Advantage (Part C) combines hospital, medical, and sometimes drug coverage into one plan. Medigap (supplemental) helps pay out-of-pocket costs not covered by Original Medicare. I can help you compare both based on your health, budget, and lifestyle.

Do I need to enroll in Part D if I don’t take any medications?

Yes — in most cases, if you don’t enroll in a Part D plan when you're first eligible, you may face late enrollment penalties down the road. Even a basic plan can help protect you in the future.

What if I’m helping a parent with Medicare?

That’s very common, and I’m genuinely pleased to assist adult children who are navigating the challenges of supporting their parents. Together, we will carefully walk through the entire process, ensuring that everyone involved feels confident, well-informed, and supported as we address their needs. My goal is to make this journey as smooth as possible for both you and your parents, providing guidance every step of the way.